Business Debt Collection Fundamentals Explained

Wiki Article

5 Easy Facts About Dental Debt Collection Explained

Table of ContentsPrivate Schools Debt Collection for BeginnersThe Basic Principles Of Business Debt Collection Getting The Private Schools Debt Collection To WorkSome Known Facts About Debt Collection Agency.

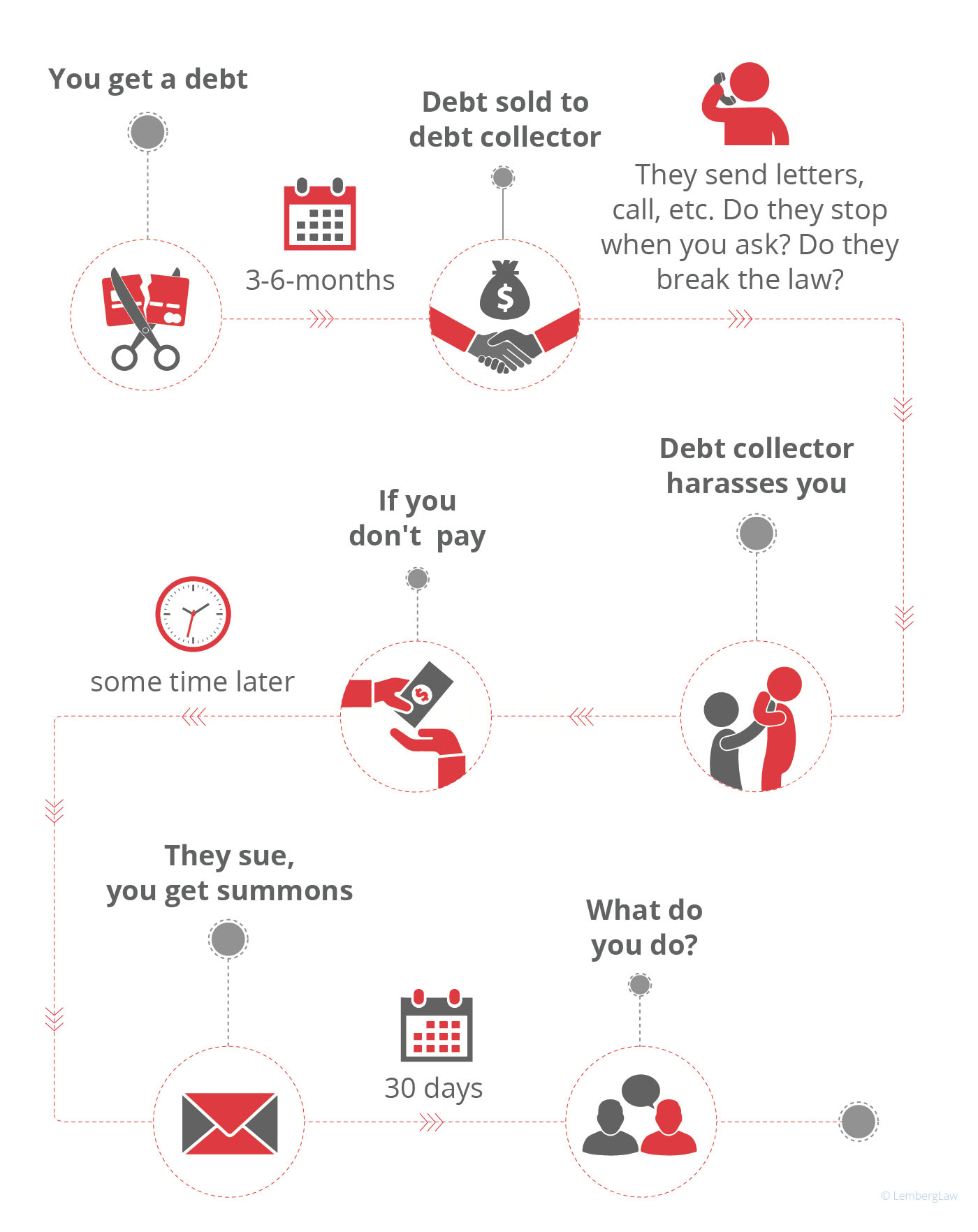

The financial debt purchaser buys just a digital file of information, often without sustaining evidence of the financial debt. The financial obligation is likewise generally older debt, sometimes referred to as "zombie financial debt" since the financial debt purchaser tries to restore a financial debt that was beyond the law of restrictions for collections. Debt debt collector might contact you either in creating or by phone.

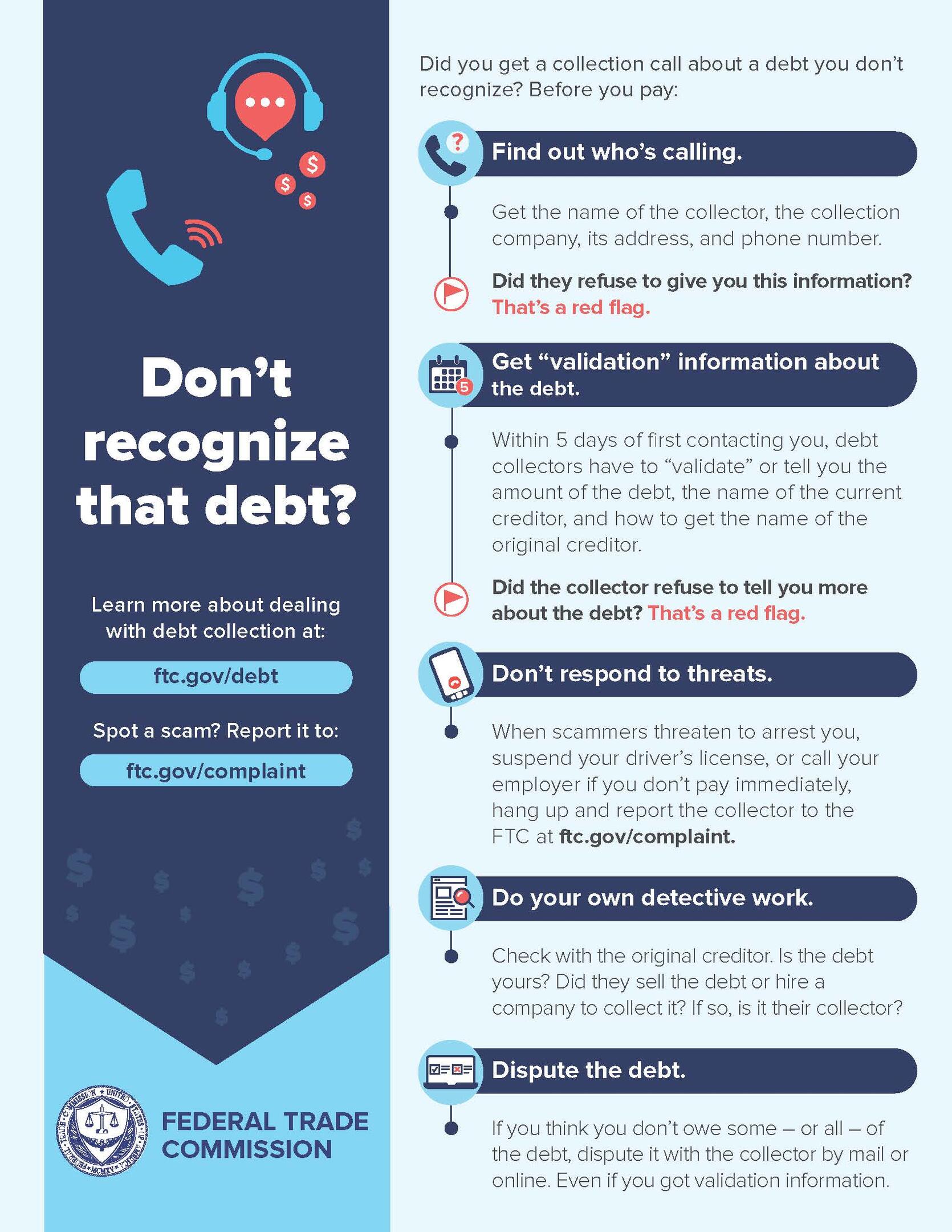

Not speaking to them won't make the debt go away, and also they might simply try alternative approaches to call you, including suing you. When a financial obligation enthusiast calls you, it's vital to obtain some initial information from them, such as: The financial debt collection agency's name, address, and also contact number. The complete amount of the debt they declare you owe, consisting of any charges as well as rate of interest charges that might have built up.

Excitement About Dental Debt Collection

The letter should mention that it's from a debt collection agency. They should likewise inform you of your legal rights in the debt collection procedure, and exactly how you can dispute the financial obligation.If you do dispute the financial obligation within 1 month, they should cease collection initiatives until they give you with proof that the financial debt is your own. They must give you with the name as well as address of the original financial institution if you request that info within one month. The financial obligation recognition notice have to consist of a kind that can be made use of to contact them if you desire to dispute the financial debt.

Some things financial obligation collectors can refrain are: Make repeated contact us to a debtor, intending to irritate the borrower. Intimidate physical violence. Use obscenity. Lie concerning how much you owe or claim to call from an official federal government office. Normally, unpaid financial debt is reported to the credit history bureaus when it's thirty days unpaid.

If your debt why not check here is transferred to a financial debt collector or sold to a financial obligation customer, an entry will be made on your credit rating record. Each time your financial obligation is offered, if it remains to go unsettled, another entry will certainly be contributed to your credit record. Each unfavorable entry on your credit scores record can continue to be there for up to seven years, even after the debt has been paid.

6 Easy Facts About Dental Debt Collection Explained

What should you expect from a collection agency and also exactly how does the process work? Continue reading to figure out. As soon as you've made the choice to employ a debt collection agency, see to it you choose the ideal one. If you adhere to the guidance below, you can be certain that you have actually employed a reputable agency that will certainly manage your account with care.For instance, some are better at getting arise from larger organizations, while others are proficient at accumulating from home-based businesses. See to it you're working with a company that will really offer your demands. This may appear obvious, however prior to you work with a debt collection agency, you need to make sure that they are certified and also accredited to work as financial debt enthusiasts.

Prior to you useful reference start your search, understand the licensing requirements for debt collector in your state. That means, when you are talking to companies, you can speak wisely about your state's requirements. Consult the companies you speak to to guarantee they satisfy the licensing demands for your state, especially if they are located in other places. from this source

You need to also examine with your Better Organization Bureau as well as the Industrial Debt Collector Organization for the names of trusted as well as highly related to financial debt collectors. While you might be passing along these debts to an enthusiast, they are still representing your firm. You require to know exactly how they will represent you, exactly how they will certainly collaborate with you, and also what relevant experience they have.

Business Debt Collection for Dummies

Simply due to the fact that a tactic is lawful does not indicate that it's something you desire your firm name related to. A respectable financial debt enthusiast will certainly deal with you to set out a strategy you can deal with, one that treats your former clients the method you would certainly desire to be dealt with and also still does the job.If that occurs, one method many firms use is miss mapping. You ought to likewise dig into the collection agency's experience. Appropriate experience boosts the possibility that their collection efforts will be effective.

You need to have a point of contact that you can connect with and obtain updates from. Business Debt Collection. They should have the ability to clearly articulate what will be anticipated from you while doing so, what information you'll need to give, and also what the cadence and activates for communication will be. Your selected firm must be able to suit your picked interaction needs, not force you to accept their own

No matter whether you win such a case or otherwise, you wish to be sure that your firm is not the one responsible. Request for proof of insurance policy from any type of debt collection agency to safeguard on your own. This is most usually called an errors and omissions insurance coverage. Debt collection is a service, and it's not an affordable one.

Report this wiki page